Featured

Table of Contents

- – Breaking Down Retirement Income Fixed Vs Varia...

- – Understanding Variable Vs Fixed Annuities A Co...

- – Understanding Fixed Annuity Vs Variable Annui...

- – Breaking Down Deferred Annuity Vs Variable An...

- – Analyzing Variable Vs Fixed Annuities A Comp...

- – Highlighting Deferred Annuity Vs Variable An...

- – Decoding Fixed Income Annuity Vs Variable Gr...

Allow's speak about Fixed Annuities versus variable annuities, which I enjoy to speak about. Now, please note, I don't offer variable annuities. I simply do not. You say, "Well, why?" That is an excellent inquiry. The factor is I do not offer anything that has the potential to decrease. I offer legal guarantees.

All right, I'm going to explain annuities. That far better to clarify annuities than America's annuity representative, Stan The Annuity Guy.

I will call them shared funds due to the fact that guess what? Variable annuities offered out in the hinterland are amongst the most preferred annuities. Currently, variable annuities were placed on the earth in the '50s for tax-deferred growth, and that's amazing.

I understand, yet I would claim that between 2% to 3% generally is what you'll locate with a variable annuity cost for the policy's life. Every year, you're stuck beginning at minus 2 or minus three, whatever those costs are.

Breaking Down Retirement Income Fixed Vs Variable Annuity Key Insights on Fixed Indexed Annuity Vs Market-variable Annuity What Is the Best Retirement Option? Pros and Cons of Variable Annuity Vs Fixed Indexed Annuity Why Choosing the Right Financial Strategy Is a Smart Choice Retirement Income Fixed Vs Variable Annuity: Explained in Detail Key Differences Between Fixed Vs Variable Annuity Pros And Cons Understanding the Key Features of Fixed Annuity Or Variable Annuity Who Should Consider Strategic Financial Planning? Tips for Choosing Pros And Cons Of Fixed Annuity And Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Fixed Vs Variable Annuity Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Fixed Income Annuity Vs Variable Growth Annuity A Closer Look at How to Build a Retirement Plan

I indicate, you can affix earnings motorcyclists to variable annuities. We have actually discovered that income motorcyclists connected to fixed annuities normally use a greater contractual guarantee.

And as soon as again, please note, I do not sell variable annuities, but I know a whole lot concerning them from my previous life. There are no-load variable annuities, which means that you're fluid on day one and pay a very minor low, low, low cost.

Understanding Variable Vs Fixed Annuities A Comprehensive Guide to Investment Choices Breaking Down the Basics of Investment Plans Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is Worth Considering How to Compare Different Investment Plans: How It Works Key Differences Between Deferred Annuity Vs Variable Annuity Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Index Annuity Vs Variable Annuity FAQs About Deferred Annuity Vs Variable Annuity Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Smart Investment Decisions A Closer Look at Annuities Variable Vs Fixed

If you're going to say, "Stan, I need to get a variable annuity," I would say, go get a no-load variable annuity, and have an expert cash manager handle those different accounts internally for you. Once again, there are limitations on the choices. There are constraints on the choices of shared funds, i.e., separate accounts.

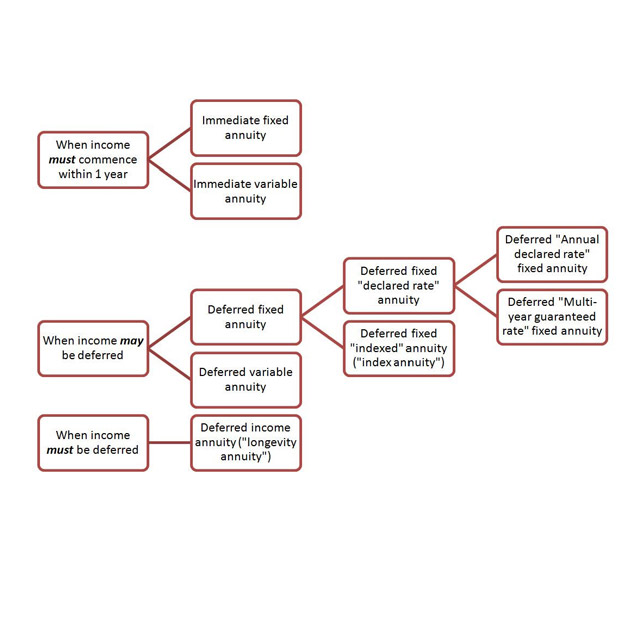

It's hard to contrast one Fixed Annuity, a prompt annuity, to a variable annuity because a prompt annuity's are for a lifetime earnings. Same point to the Deferred Revenue Annuity and Qualified Durability Annuity Contract.

Those are pension products. Those are transfer danger products that will pay you or pay you and a spouse for as long as you are breathing. However I think that the better connection for me to compare is considering the fixed index annuity and the Multi-Year Assurance Annuity, which by the method, are released at the state level.

Now, the issue we're encountering in the sector is that the indexed annuity sales pitch sounds strangely like the variable annuity sales pitch yet with primary security. And you're around going, "Wait, that's precisely what I want, Stan The Annuity Man. That's specifically the product I was searching for.

Index annuities are CD products issued at the state degree. Okay? Duration. End of story. They were placed on the planet in 1995 to take on typical CD rates. And in this world, normal MYGA taken care of rates. That's the kind of 2 to 4% world you're considering. And there are a great deal of people that call me, and I obtained a telephone call recently, this is a fantastic instance.

Understanding Fixed Annuity Vs Variable Annuity Everything You Need to Know About Financial Strategies What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Choosing the Right Financial Strategy Is Worth Considering Fixed Vs Variable Annuity: A Complete Overview Key Differences Between Different Financial Strategies Understanding the Risks of Tax Benefits Of Fixed Vs Variable Annuities Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Income Annuity Vs Variable Annuity FAQs About What Is Variable Annuity Vs Fixed Annuity Common Mistakes to Avoid When Choosing Fixed Income Annuity Vs Variable Growth Annuity Financial Planning Simplified: Understanding Immediate Fixed Annuity Vs Variable Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at Fixed Indexed Annuity Vs Market-variable Annuity

The man stated I was going to get 6 to 9% returns. I remain in year three and balanced 1.9% in a surging advancing market." And I'm like, "Well, the bright side is you're never ever mosting likely to lose cash. And that 1.9% was secured in each year, and it's never ever mosting likely to go listed below that, and so on." And he seethed.

Let's just state that. And so I was like, "There's very little you can do because it was a 10-year product on the index annuity, which implies there are surrender charges."And I always tell people with index annuities that have the 1 year phone call alternative, and you get a 10-year surrender charge product, you're acquiring an one-year assurance with a 10-year surrender charge.

Index annuities versus variable. The annuity sector's version of a CD is now a Multi-Year Guarantee Annuity, contrasted to a variable annuity.

It's not a MYGA, so you can not compare the 2. It really boils down to the 2 concerns I constantly ask individuals, what do you desire the cash to do contractually? And when do you want those contractual guarantees to begin? That's where taken care of annuities can be found in. We're chatting concerning agreements.

Breaking Down Deferred Annuity Vs Variable Annuity A Closer Look at How Retirement Planning Works What Is the Best Retirement Option? Pros and Cons of Fixed Index Annuity Vs Variable Annuity Why Annuities Variable Vs Fixed Can Impact Your Future Fixed Interest Annuity Vs Variable Investment Annuity: Explained in Detail Key Differences Between Fixed Vs Variable Annuity Pros And Cons Understanding the Risks of Pros And Cons Of Fixed Annuity And Variable Annuity Who Should Consider Fixed Annuity Or Variable Annuity? Tips for Choosing Retirement Income Fixed Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Your Options A Beginner’s Guide to Annuity Fixed Vs Variable A Closer Look at How to Build a Retirement Plan

Ideally, that will certainly alter because the industry will certainly make some modifications. I see some cutting-edge products coming for the signed up financial investment advisor in the variable annuity globe, and I'm going to wait and see how that all shakes out. Never ever fail to remember to live in fact, not the desire, with annuities and contractual assurances! You can utilize our calculators, obtain all 6 of my publications free of cost, and most significantly book a phone call with me so we can go over what works best for your certain circumstance.

Annuities are a kind of investment product that is frequently used for retired life planning. They can be referred to as contracts that provide payments to a specific, for either a details time duration, or the remainder of your life. In easy terms, you will spend either an one-time payment, or smaller regular payments, and in exchange, you will certainly get payments based on the amount you spent, plus your returns.

The price of return is evaluated the beginning of your agreement and will certainly not be impacted by market fluctuations. A set annuity is a wonderful choice for a person searching for a steady and predictable income. Variable Annuities Variable annuities are annuities that enable you to invest your costs into a selection of options like bonds, supplies, or mutual funds.

While this suggests that variable annuities have the possible to give greater returns contrasted to repaired annuities, it likewise indicates your return rate can vary. You may have the ability to make even more profit in this situation, yet you also risk of potentially losing money. Fixed-Indexed Annuities Fixed-indexed annuities, additionally called equity-indexed annuities, combine both dealt with and variable attributes.

Analyzing Variable Vs Fixed Annuities A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Features of Smart Investment Choices Why Variable Vs Fixed Annuity Is a Smart Choice Deferred Annuity Vs Variable Annuity: How It Works Key Differences Between Fixed Vs Variable Annuity Pros Cons Understanding the Key Features of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Annuity Vs Variable Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Choosing Annuity Fixed Vs Variable Financial Planning Simplified: Understanding Fixed Vs Variable Annuity Pros Cons A Beginner’s Guide to Fixed Vs Variable Annuity A Closer Look at What Is Variable Annuity Vs Fixed Annuity

This offers a set degree of earnings, as well as the possibility to make additional returns based on other investments. While this generally shields you against losing revenue, it likewise restricts the profits you could be able to make. This kind of annuity is an excellent option for those trying to find some safety and security, and the potential for high incomes.

These financiers purchase shares in the fund, and the fund invests the cash, based on its specified purpose. Mutual funds include options in significant possession courses such as equities (stocks), fixed-income (bonds) and money market securities. Investors share in the gains or losses of the fund, and returns are not ensured.

Financiers in annuities move the threat of lacking money to the insurer. Annuities are often a lot more pricey than shared funds as a result of this attribute. There are two various kinds of annuities in your plan: "guaranteed" and "variable." An assured annuity, such as TIAA Traditional, guarantees income throughout retirement.

Both mutual funds and annuity accounts supply you a range of options for your retired life financial savings needs. Investing for retirement is only one component of preparing for your financial future it's simply as vital to identify just how you will certainly receive income in retired life. Annuities normally supply more options when it pertains to acquiring this revenue.

Highlighting Deferred Annuity Vs Variable Annuity Everything You Need to Know About Variable Vs Fixed Annuity What Is the Best Retirement Option? Features of Smart Investment Choices Why Variable Annuity Vs Fixed Annuity Is Worth Considering How to Compare Different Investment Plans: Simplified Key Differences Between Variable Annuity Vs Fixed Annuity Understanding the Risks of Long-Term Investments Who Should Consider What Is Variable Annuity Vs Fixed Annuity? Tips for Choosing Variable Vs Fixed Annuity FAQs About Planning Your Financial Future Common Mistakes to Avoid When Planning Your Retirement Financial Planning Simplified: Understanding Fixed Vs Variable Annuity Pros And Cons A Beginner’s Guide to Variable Vs Fixed Annuity A Closer Look at How to Build a Retirement Plan

You can take lump-sum or methodical withdrawals, or select from the following revenue alternatives: Single-life annuity: Deals normal benefit payments for the life of the annuity proprietor. Joint-life annuity: Deals regular benefit repayments for the life of the annuity proprietor and a partner. Fixed-period annuity: Pays income for a specified number of years.

:max_bytes(150000):strip_icc()/VariableAnnuitization-asp-v1-5dedf8fee4694d8dacd2ac7eb7b0757e.jpg)

For assistance in developing an investment technique, call TIAA at 800 842-2252, Monday with Friday, 8 a.m.

Investors in financiers annuities delayed periodic investments regular build up construct large sumBig amount which the payments begin. Get quick responses to your annuity inquiries: Call 800-872-6684 (9-5 EST) What is the difference in between a repaired annuity and a variable annuity? Fixed annuities pay the very same amount each month, while variable annuities pay an amount that depends on the financial investment efficiency of the financial investments held by the particular annuity.

Why would certainly you desire an annuity? Tax-Advantaged Investing: As soon as funds are spent in an annuity (within a retirement strategy, or not) growth of resources, dividends and rate of interest are all tax obligation deferred. Investments into annuities can be either tax obligation insurance deductible or non-tax deductible payments depending on whether the annuity is within a retirement or not.

Circulations from annuities paid for by tax insurance deductible payments are fully taxable at the recipient's then existing earnings tax obligation price. Distributions from annuities paid for by non-tax deductible funds are subject to unique treatment due to the fact that some of the periodic payment is really a return of funding invested and this is not taxable, just the interest or financial investment gain portion is taxable at the recipient's after that present income tax obligation price.

Decoding Fixed Income Annuity Vs Variable Growth Annuity A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Benefits of Pros And Cons Of Fixed Annuity And Variable Annuity Why Choosing the Right Financial Strategy Can Impact Your Future Fixed Index Annuity Vs Variable Annuities: How It Works Key Differences Between Annuities Variable Vs Fixed Understanding the Rewards of Long-Term Investments Who Should Consider Strategic Financial Planning? Tips for Choosing Fixed Annuity Vs Variable Annuity FAQs About Deferred Annuity Vs Variable Annuity Common Mistakes to Avoid When Choosing a Financial Strategy Financial Planning Simplified: Understanding What Is A Variable Annuity Vs A Fixed Annuity A Beginner’s Guide to Smart Investment Decisions A Closer Look at How to Build a Retirement Plan

(For much more on tax obligations, see IRS Magazine 575) I was reluctant at initial to acquire an annuity on the web. You made the entire point go truly basic.

This is the topic of one more short article.

Table of Contents

- – Breaking Down Retirement Income Fixed Vs Varia...

- – Understanding Variable Vs Fixed Annuities A Co...

- – Understanding Fixed Annuity Vs Variable Annui...

- – Breaking Down Deferred Annuity Vs Variable An...

- – Analyzing Variable Vs Fixed Annuities A Comp...

- – Highlighting Deferred Annuity Vs Variable An...

- – Decoding Fixed Income Annuity Vs Variable Gr...

Latest Posts

Breaking Down Your Investment Choices Key Insights on Your Financial Future What Is Fixed Annuity Vs Equity-linked Variable Annuity? Advantages and Disadvantages of Different Retirement Plans Why Fixe

Decoding How Investment Plans Work Key Insights on Your Financial Future Breaking Down the Basics of What Is Variable Annuity Vs Fixed Annuity Advantages and Disadvantages of What Is A Variable Annuit

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future Defining the Right Financial Strategy Benefits of Choosing the Right Financial Plan Why Retirement Income Fixed Vs Variabl

More

Latest Posts